In this photo provided by the New York Stock Exchange, trader James Macgilvray works on the floor, Monday, June 13, 2022. Fears about a possible recession are pounding markets worldwide on Monday, and Wall Street’s S&P 500 tumbled into the maw of what’s known as a bear market after sinking more than 20% below its record set early this year. (Courtney Crow/New York Stock Exchange via AP)

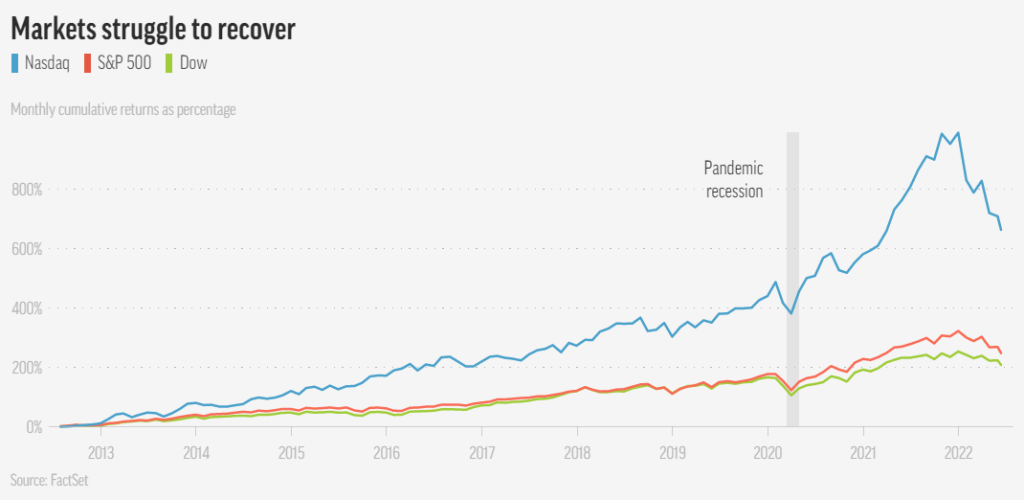

NEW YORK (AP) — Fears about a possible recession are pounding markets Monday, and Wall Street’s S&P 500 tumbled into the maw of what’s known as a bear market after sinking more than 20% below its record set early this year.

The S&P 500 dropped 2.7% in the first chance for investors to trade after getting the weekend to reflect on the stunning news that inflation is getting worse, not better. The Dow Jones Industrial Average was down 591 points, or 1.9%, at 30,792 as of 1:58 p.m. Eastern time, and the Nasdaq composite was 3.4% lower.

The center of Wall Street’s focus was again on the Federal Reserve, which is scrambling to get inflation under control. Its main method is to raise interest rates in order to slow the economy, a blunt tool that risks a recession if used too aggressively.

With the Fed seemingly pinned into having to get more aggressive, prices tumbled for everything from bonds to bitcoin, from New York to New Zealand, with the sharpest drops hitting the biggest winners of the earlier low-rate era.

“The best thing people can do is to not panic and don’t sell at the bottom,” said Randy Frederick, managing director of trading and derivatives at the Schwab Center for Financial Research, “and we’re probably not at the bottom.”

Some economists are even speculating the Fed on Wednesday may raise its key short-term interest rate by three-quarters of a percentage point. That’s triple the usual amount and something the Fed hasn’t done since 1994. Traders now see a 28% probability of such a mega-hike, up from just 3% a week ago, according to CME Group.

No one thinks the Fed will stop there, with markets bracing for a continued series of bigger-than-usual hikes. Those would come on top of some already discouraging signals about the economy and corporate profits, including a record-low preliminary reading on consumer sentiment that was soured by high gasoline prices.

It’s all a sharp turnaround from earlier in the pandemic, when central banks worldwide slashed rates to record lows and made other moves that propped up prices for stocks and other investments in hopes of juicing the economy.

Such expectations are also sending U.S. bond yields to their highest levels in more than a decade. The two-year Treasury yield shot to 3.23% from 3.06% late Friday after touching its highest level since 2007, according to Tradeweb. It’s more than quadrupled this year.

The 10-year yield jumped to 3.34% from 3.15%, and the higher level will make mortgages and many other kinds of loans for households and for businesses more expensive. It has more than doubled this year and touched its highest level since 2011.

The gap between the two-year and 10-year yields has also narrowed, a signal of dropping optimism about the economy in the bond market. If the two-year yield tops the 10-year yield, some investors see it as a sign of a looming recession.

The pain for markets was worldwide as investors braced for more aggressive moves from a coterie of central banks.

In Asia, indexes fell at least 3% in Seoul, Tokyo and Hong Kong. Stocks there were also hurt by worries about COVID-19 infections in China, which could push authorities to resume tough, business-slowing restrictions.

In Europe, Germany’s DAX lost 2.4%, and the French CAC 40 fell 2.7%.

Some of the biggest hits came for cryptocurrencies, which soared early in the pandemic when record-low interest rates encouraged some investors to pile into the riskiest investments. Bitcoin tumbled more than 17% from a day earlier and dropped to $23,222, according to Coindesk. It’s back to where it was in late 2020 and down from a peak of $68,990 late last year.

On Wall Street, the S&P 500 was more than 21% below its record set early this year. If it finishes the day more than 20% below that high, it would enter what investors call a bear market.

Bears hibernate, so bears represent a market that’s retreating, said Sam Stovall, chief investment strategist at CFRA. In contrast, Wall Street’s nickname for a surging stock market is a bull market, because bulls charge, Stovall said.

The last bear market wasn’t that long ago, in 2020, but it was an unusually short one that lasted only about a month. The S&P 500 got close to a bear market last month, briefly dipping more than 20% below its record, but it didn’t finish a day below that threshold.

This would also be the first bear market for many novice investors who got into stock trading for the first time after the pandemic’s start, a period when stocks largely seemed to go only up. That is, they did until inflation showed that it was worse than just a “transitory” problem as initially portrayed.

Michael Wilson, a strategist at Morgan Stanley who’s been among Wall Street’s more pessimistic voices, is sticking with his view that the S&P 500 could fall to 3,400 even if the U.S. economy avoids a recession over the next year.

That would mark another roughly 10% drop from the current level, and Wilson said it reflects his view that Wall Street’s earnings forecasts are still too optimistic, among other things.

With soaring price tags at stores souring sentiment for shoppers, even higher-income ones, Wilson said in a report that “the next shoe to drop is a discounting cycle” as companies try to clear out built-up inventories.

Such moves would cut into their profitability, and a stock’s price moves up and down largely on two things: how much cash the company is generating and how much an investor is willing to pay for it.

The Fed’s moves factor heavily into that second part because higher rates make investors less willing to pay high prices for risky investments.

Economists at Deutsche Bank said they expect the Fed to hike rates by larger-than-usual amounts on Wednesday, again in July, then again in September and a fourth time in November. Just a week ago, before Friday’s wake-up call of an inflation report, Wall Street was debating whether the Fed may take a pause on rate hikes in September.

AP Business Writers Damian J. Troise and Elaine Kurtenbach contributed.

Copyright 2021 Associated Press. All rights reserved.

Source: https://apnews.com/article/stock-market-today-june-13-974e78ed90b690bbeeb39afda8c8d72d