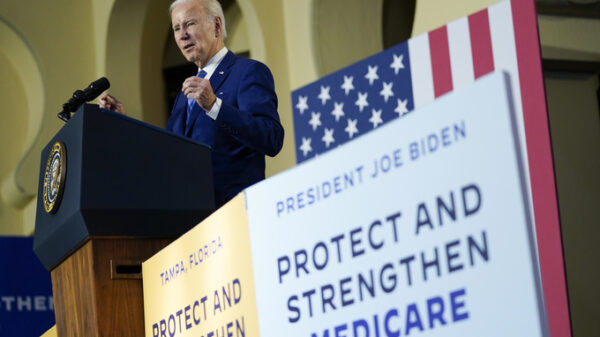

A currency trader walks by the screen showing the Korea Composite Stock Price Index (KOSPI) at the foreign exchange dealing room in Seoul, South Korea, Friday, June 4, 2021. Asian shares mostly slipped Friday, dragged lower by a decline in technology stocks on Wall Street.(AP Photo/Lee Jin-man)

TOKYO (AP) — Asian shares mostly slipped Friday, dragged lower by a decline in technology stocks on Wall Street.

Benchmarks fell in Japan, South Korea and China but rose in Australia.

Traders are awaiting the U.S. government’s latest monthly jobs report, expected later Friday. Unemployment data announced Thursday was encouraging.

But while an improved jobs market suggests the economy is gaining momentum after the pandemic, investors are keeping a close eye on signs of inflation, which especially hurts the tech sector. The benchmark S&P 500 index dropped 0.4% on Thursday and is on track for a 0.3% weekly loss.

Japan’s benchmark Nikkei 225 slipped 0.5% to 28,902.90. South Korea’s Kospi lost 0.6% to 3,229.34, while Australia’s S&P/ASX 200 inched up 0.1% to 7,268.20. Hong Kong’s Hang Seng fell 0.1% to 28,945.85 and the Shanghai Composite lost 0.1% at 3,580.58.

“Asian markets will likely be in a holding pattern on Friday,” Prakash Sakpal and Nicholas Mapa, senior economists at ING, said in a report.

“More importantly, investors will await the US non-farm payrolls report out later tonight.”

On Thursday, technology companies, whose pricey valuations make them more sensitive to inflation fears, were the biggest weight on the market.

The S&P 500 fell 15.27 points to 4,192.85. The Dow Jones Industrial Average dropped 0.1% to 34,577.04. The tech-heavy Nasdaq lost 1% to 13,614.51. The Russell 2000 index of smaller companies gave up 0.8% to 2,279.25.

Microsoft fell 0.6% and Apple lost 1.2%.

Retailers, hotel operators and a variety of other companies that rely on direct consumer spending also posted some of the biggest declines, as did communications companies. Etsy slid 5.4%, Tesla dropped 5.3%, Wynn Resorts fell 4.1% and Facebook lost 0.9%. Banks and health care companies rose.

AMC Entertainment slumped 17.9%, shedding gains from a brief rally, after the movie theater operator said it would sell more shares after a huge run-up in its stock price on a surge of interest from individual investors. The stock is still up about 2,300% this year.

General Motors jumped 6.4% after saying it expects earnings in the first half of the year to exceed its earlier forecasts after it did a better job of managing a global computer chip shortage than expected. Rival Ford Motor climbed 7.2% for the biggest gain in the S&P 500.

While falling unemployment numbers are encouraging, they also come with rising labor costs. Labor costs rose at a 1.7% rate in the first quarter, up from the initial estimate that they had fallen 0.3%. That could stoke more fears that inflation might run hotter than expected.

The jobs report Friday could provide more clarity on the economic recovery and the potential for higher inflation. Economists are projecting that it will show employers added 650,000 jobs in May.

Rising inflation is expected as the economy recovers from the pandemic’s impact, but the key question for many on Wall Street is whether it will be temporary or more permanent.

“The main concern in the markets, rightfully so, is inflation,” said Cliff Hodge, chief investment officer for Cornerstone Wealth. “Data points are beginning to confirm the view that inflation is likely to be more sticky.”

The concern is that the global recovery could be hampered if governments and central banks have to withdraw stimulus to combat rising prices.

In energy trading, benchmark U.S. crude fell 7 cents to $68.74 a barrel in electronic trading on the New York Mercantile Exchange. It gave up 2 cents to $68.81 on Thursday. Brent crude, the international standard, slipped 9 cents to $71.72 a barrel.

In currency trading, the U.S. dollar weakened to 110.21 Japanese yen from 110.29 yen. The euro cost $1.2118, down from $1.2127.

Damian J. Troise and Alex Veiga contributed.

Copyright 2020 Associated Press. All rights reserved.